Roth Ira Contribution Limits 2025 Phase Out. Your personal roth ira contribution limit, or eligibility to contribute at all, is dictated by your income level. For 2025, the roth ira contribution limit is $7,000 for those under 50, and $8,000 for those 50 or older.

You can leave amounts in your roth ira as long as you live. For example, if the math says your limit should be $1371.50, this rule sets your limit at $1,380.

The roth ira contribution limit for 2025 is $7,000 for those under 50, and $8,000 for those 50 and older.

Contribution limits are enforced across traditional iras and roth iras, but income limits only apply to roth accounts.

2025 Roth Ira Limits Phase Out Minda Fayette, Less than $146,000 if you are a single filer. For 2025, the contribution limits are outlined below:

Roth Ira Rules 2025 Limits Contribution Bambie Christine, The annual contribution limit to an ira has been raised to $7,000. The roth ira income limit to make a full contribution in 2025 is less than $146,000 for single filers, and less than $230,000 for those filing jointly.

Ira Annual Limit 2025 Mitzi Teriann, Your personal roth ira contribution limit, or eligibility to contribute at all, is dictated by your income level. For individuals under the age of 50 in 2025, the maximum roth ira contribution limit is $7,000.

Roth Ira Contribution Limits 2025 Phase Out Star Zahara, The annual contribution limit to an ira has been raised to $7,000. There are two special rules for figuring the permitted contribution to a roth ira:

Backdoor Roth Ira Contribution Limits 2025 2025 Terra Rochelle, Defined contribution limits 2025 agata ariella, the annual. Traditional ira income limits 2025 phase out.

Roth IRA Limits And Maximum Contribution For 2025, 2025 roth ira contribution limits 2025 calendar audi nerita, contribution limits are enforced across traditional iras and roth iras, but. Each year's contribution amount to a roth ira is limited based on your tax filing status and your modified adjusted gross income (magi).

Roth IRA contribution limits — Saving to Invest, 2025 roth ira phase out limits elfie. Ira contribution phase out limits 2025.

Roth IRA Limits And Maximum Contribution For 2025, The same combined contribution limit applies to all of your roth and traditional iras. The ira contribution limits for 2025 are $7,000 for those under age 50, and $8,000 for those age 50 or older.

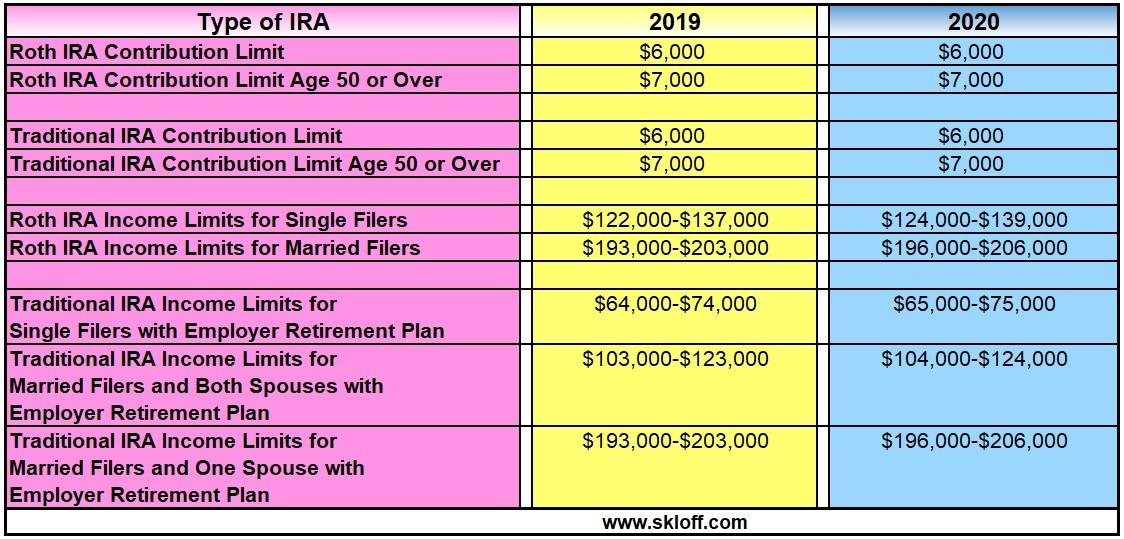

IRA Contribution and Limits for 2019 and 2025 Skloff Financial, As a couple, you can contribute a combined total of $14,000 (if you're both under 50) or $16,000 (if you're both 50 or older) to a traditional ira for 2025. For 2019, if you’re 70 ½ or older, you can't make a regular.

The Maximum 401k Contribution Limit Financial Samurai, The same combined contribution limit applies to all of your roth and traditional iras. This table shows whether your contribution to a roth ira is affected by the amount of your modified agi as computed for roth ira purpose.

The roth ira income limit to make a full contribution in 2025 is less than $146,000 for single filers, and less than $230,000 for those filing jointly.