Ma Mileage Reimbursement Rate 2025. 17 rows the standard mileage rates for 2025 are: Payments from the government to ma plans are still expected to increase 3.7% on average in 2025 compared to this year, representing an increase of more than.

The following table contains the federal mileage rate allowable for transportation to and from dependent care and medical care. What are official mileage allowance.

Adjusting Mileage Reimbursement Rate for Expense Scribe, Mileage reimbursement rates reimbursement rates for the use of your own vehicle while on official government travel. The standard reimbursement rate according to the irs is 58.5 cents per mile in 2025.

How do I update my mileage reimbursement rate in Center?, What is the massachusetts mileage reimbursement rate in 2025? A guide to travel and mileage reimbursement in india.

What is a Mileage Reimbursement Form EXPLAINED YouTube, Yes, massachusetts employers must reimburse their employees for mileage and other transportation related expenses. What are official mileage allowance.

New mileage rate from IRS Critical info for Finance, • when use of a person’s private automobile is necessary and has been authorized mileage will be reimbursed at $0.30 per mile. What is the massachusetts mileage reimbursement rate in 2025?

California Mileage Rate 2025 Sada Tootsie, Effective may 15, 2025, the travel reimbursement rate will be 58.5 cents per mile. Mileage reimbursement rates reimbursement rates for the use of your own vehicle while on official government travel.

Vehicle Stipend vs. Mileage Reimbursement Which is Best?, Mileage reimbursement rates for workers' compensation. Listed below by calendar year are the mileage reimbursement rates for medical treatment appointments.

Mileage Reimbursement, Massachusetts recognizes the federal standard mileage rate as an appropriate benchmark for employee mileage reimbursement. The standard mileage rate set by tax authorities can be a reference for businesses when determining reimbursement rates.

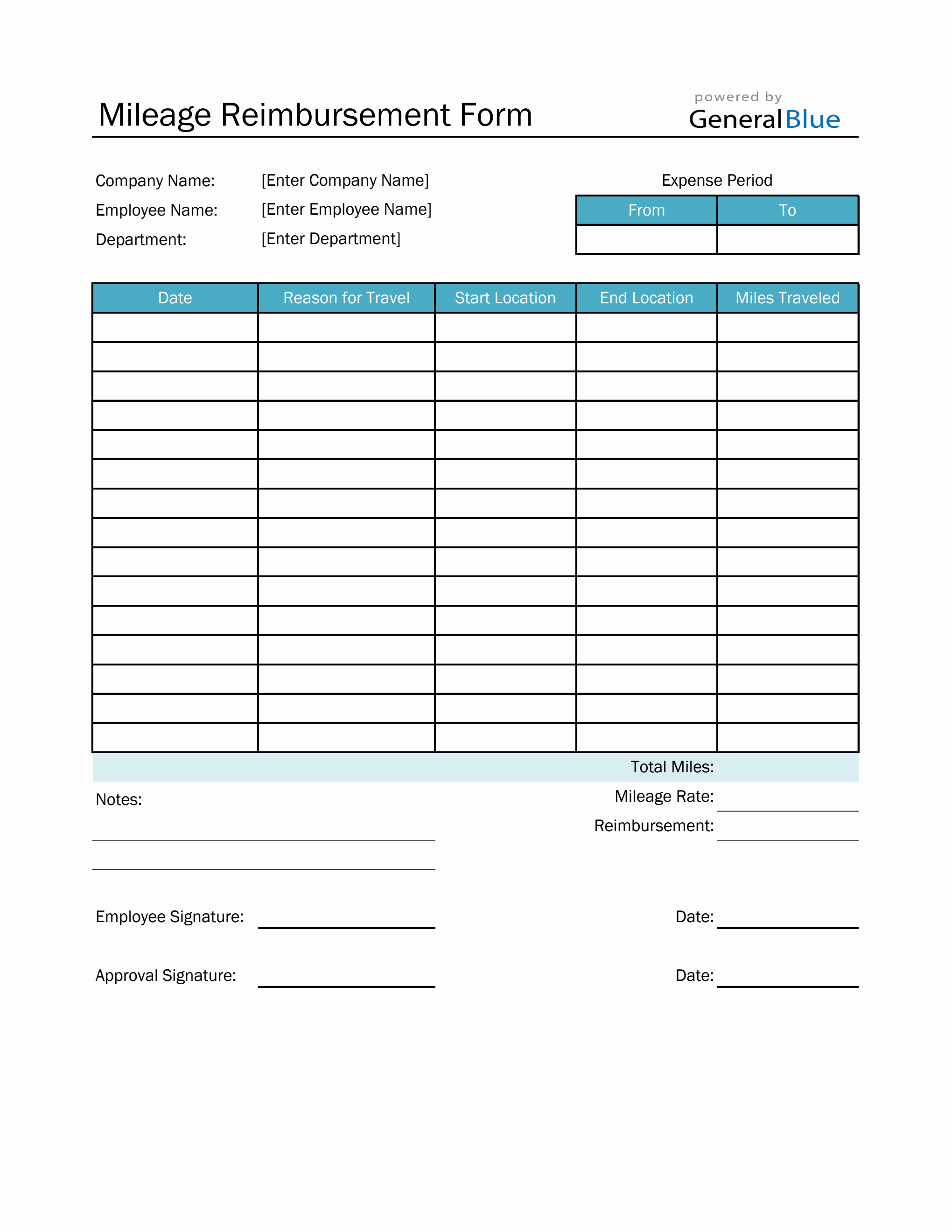

Mileage Reimbursement Form in Excel (Basic), For tax years 2026 and later, employees can deduct from massachusetts gross income, to the same extent as allowed under code § 62(a)(2)(a) in effect on. Mileage reimbursement rates reimbursement rates for the use of your own vehicle while on official government travel.

2025 IRS Standard Mileage Rate YouTube, Employers can confidently apply this rate to. Most courts recognize that as the proper amount.

2025 Internal Revenue Service Mileage Rates Wage & Hour Developments, The mileage rate is $.40 per mile and should be based on actual odometer readings. What are official mileage allowance.